Marinko Ostojic

Friday, 07 October 2016 09:10

Personalizing by charitable organizations

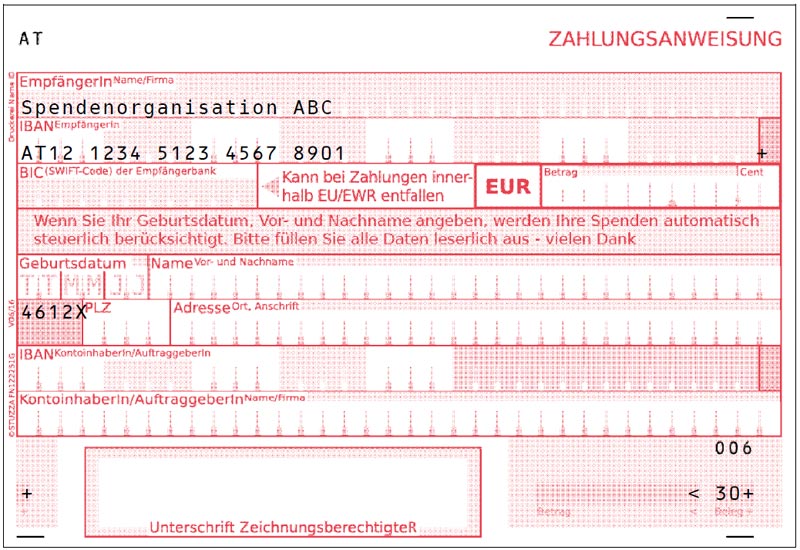

In addition to the standard payment slips there are also donation payment slips. This offers the possibility to fill in the date of birth of new donors and existing donors necessary to ensure that donations may be deducted. On this new donation slip a QR code does not make sense because it leaves insufficient space for the data to be collected.

Donation order for new donors

Donation order for new donors

- Purpose: The donation payment slip is used when the donor is completely unknown. This slip is available to the public (e.g., in bank foyers) or is widely distributed (e.g., newspaper insert, circulars, etc.)

- Addressee: First time donor

- Use: one time

- What is to be pre-printed?

- Organization name and IBAN

- Optional: freely selected four-digit action code for the identification of the campaign / edition / ...

- IMPORTANT: Insert an "X" to distinguish between action / campaign and post code.

Published in

Seite

Tagged under

Wednesday, 02 December 2015 13:21

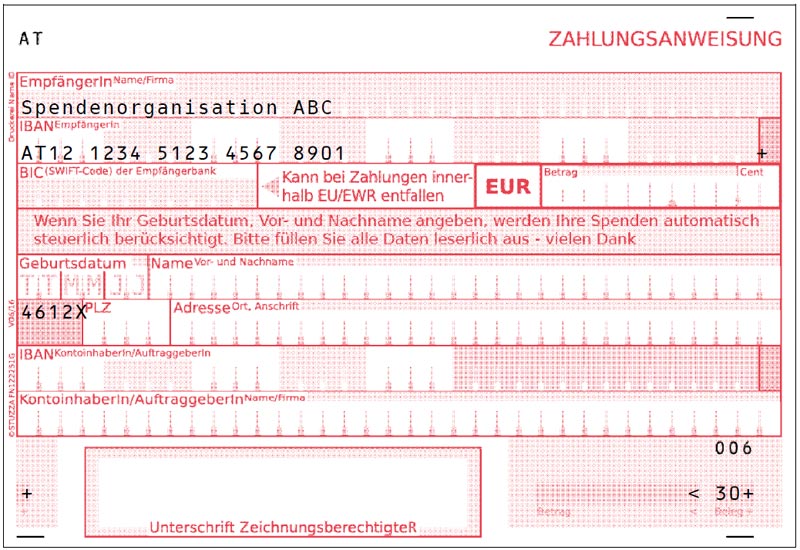

IBAN only - since Februar 2nd 2016 the BIC can be left out within EU/EWR

STUZZA has taken the opportunity to playce the "IBAN only" information on the payment slip. The text between "BIC" and the currency "EUR" has been altered.

STUZZA has taken the opportunity to playce the "IBAN only" information on the payment slip. The text between "BIC" and the currency "EUR" has been altered. IBAN only is valid since Februar 2nd 2016.

If the data-basis from which payment slips are personalized contains the correct BIC it doesn´t have to be removed and may still be printed onto the payment slip. You may use your payment slips in stock and after that produce payment slips with the actual note and the Version V 10/15. Visit our homepage and get all the actual information regarding the payment slip.

The description of the QR-Codes has been altered as well. Link.

Published in

News

Tagged under

Thursday, 30 July 2015 07:04

Imprint

| Company | PSA Payment Services Austria GmbH |

| Legal form | Company with limited liability |

| Address | Handelskai 92, Gate 2 |

| 1200 Vienna | |

| Telephone | +43 1 717 18 0 |

| Fax | +43 1 717 18 900 |

| office(at)psa.at | |

| Website | http://www.psa.at |

| Headquarters | Vienna |

| Commercial court | Commercial Court Vienna |

| Commercial register number | FN370048p |

| VAT number | ATU66782626 |

| Chamber membership | 1. Austrian Chamber of Commerce |

| Federal Division, Information and Consulting | |

| Association of Financial Service Providers | |

| 2. Austrian Chamber of Commerce Section Business Consulting, Accounting and Information Technology Professional Branch IT Service |

|

Trade authority Applicable legislation Link to the legislation |

District Office of the 2nd/20th District Commercial Code (GewO) www.ris.bka.gv.at |

Published in

Seite

Tagged under

Friday, 23 January 2015 10:42

eps Error

There is no translation available.

Unbekannter Fehler. Möglicherweise gibt es einen neuen Fehlercode, der in dieser Version des Codes noch nicht behandelt wird.

Setzen Sie sich mit dem Händler in verbindung, eventuell steht eine neue Democode-Version.

Published in

Demo

Tagged under

Friday, 23 January 2015 07:27

eps Demoshop

There is no translation available.

Published in

Demo

Tagged under

Tuesday, 20 January 2015 14:20

Demo Finanzamt-Zahlung

There is no translation available.

some content with no post

Published in

Tools

Tagged under

Friday, 16 January 2015 07:34

Gutschrifttruncation technische Hilfestellung

There is no translation available.

Published in

Seite

Tagged under

Thursday, 21 August 2014 12:43

Gutschriftstruncation

The "Gutschriftstruncation" offers a backup of allocation data (payment reference) and therefore a facilitation and a quality assurance for payees who send their customers pre-filled receipts for a more comfortable payment of claims.

Thus the payment reference is hedged with a check digit calculated in accord with ISO 7064. This check digit facilitates the automatic capture and ensures higher detection rates in the processing. Hence the automatic assigning and entering of claims achieves a significantly higher rate.

For that purpose is an Excel-Sheet available, which illustrates the calculation of check digits in the "Truncationsverfahren" and also suits the creation of small amounts of check digits.

Since the 1st January 2009 the possibility for a "Gutschriftstruncation" with the was created. It concerns an additional check digit on the "Zahlungsanweisung". This supplementary check digit ensures the correct processing of the reference on the receipt by the system. The payment reference solely consists of 35 digits.

Thus the payment reference is hedged with a check digit calculated in accord with ISO 7064. This check digit facilitates the automatic capture and ensures higher detection rates in the processing. Hence the automatic assigning and entering of claims achieves a significantly higher rate.

For that purpose is an Excel-Sheet available, which illustrates the calculation of check digits in the "Truncationsverfahren" and also suits the creation of small amounts of check digits.

Since the 1st January 2009 the possibility for a "Gutschriftstruncation" with the was created. It concerns an additional check digit on the "Zahlungsanweisung". This supplementary check digit ensures the correct processing of the reference on the receipt by the system. The payment reference solely consists of 35 digits.

Published in

Seite

Tagged under

Thursday, 21 August 2014 12:42

Tax payments

The tax payments were redeveloped and designed especially for transactions to the revenue office. Multiple types of taxes may be settled up simultaneously via receipt.

A standardised payment reference is necessary for tax payments/post bar payments respectively EACT. Further informations on this subject are available here, where we provide corresponding tools with which the payment reference can be calculated automatically.

Published in

Seite

Tagged under